A leading economist has issued a dire warning about the US economy, criticizing the Federal Reserve for a “policy blunder” that could plunge the country into recession.

Allianz’s chief economic adviser Mohamed El-Erian said on Sunday he fears the economy is entering a downward spiral after a dismal unemployment report last week.

He blames the Fed for keeping its key interest rate at its highest level in two decades since 2022 in an effort to keep inflation in check.

According to him, these rate hikes are now having a major impact on the economy, suggesting that the Fed should have lowered rates earlier.

“I really worry that we could lose American economic exceptionalism because of a policy mistake,” he said. told Bloomberg TV, as global markets continued to plummet.

Mohamed El-Erian, Allianz’s chief economic adviser, said on Sunday that for the first time in years he fears the economy could fall into recession

After the jobs report, which showed unemployment rose to its highest level in July Since October 2021, global markets have been in a downward spiral amid fears that the US economy is faltering.

A drop of almost 19 percent in Intel shares In the aftermarket trade, the gloom grew.

Economists at Goldman Sachs have now raised the chance of the US entering a recession within the next year from 15 to 25 percent, while analysts at JP Morgan put the chance of a recession at 50 percent.

To save the economy, experts say the Federal Reserve must cut interest rates much faster than planned to avoid a massive recession.

A rate cut would make it easier for American households and businesses to borrow money and boost the economy, but it could take months to a year for the full effects to be felt.

US Federal Reserve Chairman Jerome Powell left benchmark borrowing costs unchanged at their highest level in 23 years at his latest meeting.

US job growth fell far short of expectations in July and the unemployment rate rose to its highest level in nearly three years

Goldman Sachs analysts expect the Fed to cut rates by 25 basis points, but if the August jobs report is as weak as July’s, they could opt for a bigger cut.

However, analysts at JP Morgan wrote in a memo that “because it appears the Fed is significantly behind, we expect a 50% rate” [basis point] at the September meeting the number was reduced, followed by another 50 [basis point] ‘cut in November.’

Still, at its last meeting last week, the Fed left its benchmark for borrowing costs unchanged at the highest level in 23 years.

The market is now wondering whether the Fed is too late in moving on monetary policy, said Quincy Krosby, chief global strategist at LPL Financial. CNBC.

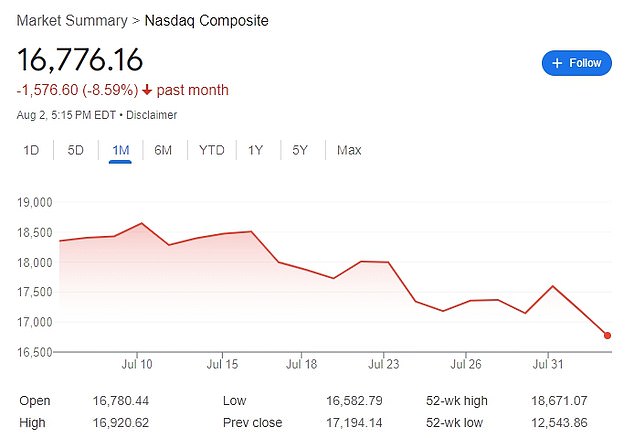

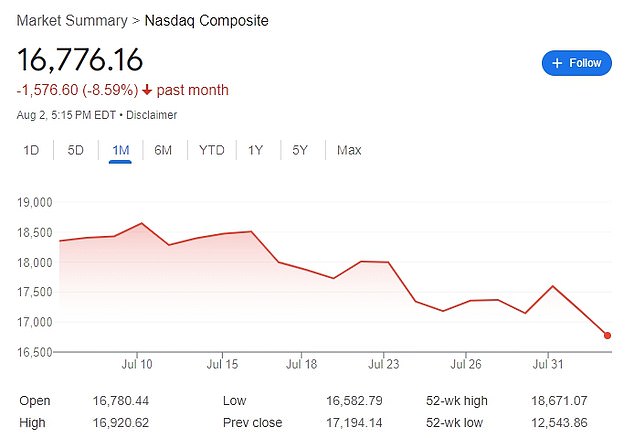

Global stocks fell after Friday’s jobs report

When markets in Asia and Australia opened Monday morning, NASDAQ futures fell 2.27 percent

When markets in Asia and Australia opened Monday morning, NASDAQ futures fell 2.27 percent, while S&P 500 futures fell 1.41 percent.

Internationally, the situation was not much better, with the EUROSTOXX 50 futures down 0.6 percent and Japan’s Nikkei losing a whopping 5.5 percent, hitting a seven-month low. This was the biggest three-session loss since 2011.

The losses followed a trend that began on Friday, when the Japanese market fell back to January levels before hitting a record high of 42,000 last month.

Elsewhere in Asia, the Hang Seng in Hong Kong fell 2.1 percent to 16,945.51 on Friday, while the Shanghai Composite index suffered a more modest loss of 0.9 percent to 2,905.34.

Chinese stocks extended their losses as investors were disappointed with the the latest efforts of the government to stimulate growth through a variety of piecemeal measures, rather than the hoped-for broader stimulus measures.

Seoul’s Kospi fell 3.7 percent to 2,676.19 and Taiwan’s Taiex fell 4.4 percent. Both markets are typically hit hard by weakness in technology stocks.

Many investors are now wondering whether the Fed waited too long to cut rates

Meanwhile, Australia’s S&P/ASX lost 2.1 percent to 7,943.20 and India’s Sensex fell 1.1 percent. Bangkok’s SET fell 0.7 percent.

Japanese stocks also fell after the central bank raised interest rates. reference rate on Wednesday, from 0.1 percent to 0.25 percent.

This caused the Japanese yen to rise against the US dollar, potentially hurting major manufacturers’ overseas revenues and holding back economic growth in tourism.

Investors are now convinced that other major central banks will follow the Fed’s lead and cut rates even more aggressively. The European Central Bank is expected to cut rates by 67 basis points by Christmas.